We know that overwhelming feeling of having to manage your money and finances – oh, do we know it. Crunching the numbers, trying to make sense of a spreadsheet, taking out insights that make sense and you can act on them.

Well, it doesn't have to be this hard. One of the simplest yet most powerful tools for gaining control of your finances is a budget spreadsheet template – a tool that brings together the numbers, the crunching, the making sense of insights in a quick minute.

So, if you’re planning a big purchase, tracking money expenses, or simply trying to keep your household bills in a tight row – a budgeting spreadsheet can provide the clarity and structure you need.

In this article, we’ll break down what a budget spreadsheet template is, how to use one effectively, and why MobiSheets is the perfect tool for managing your personal budget across devices as an alternative to Google Sheets or Excel.

What is a budget spreadsheet template?

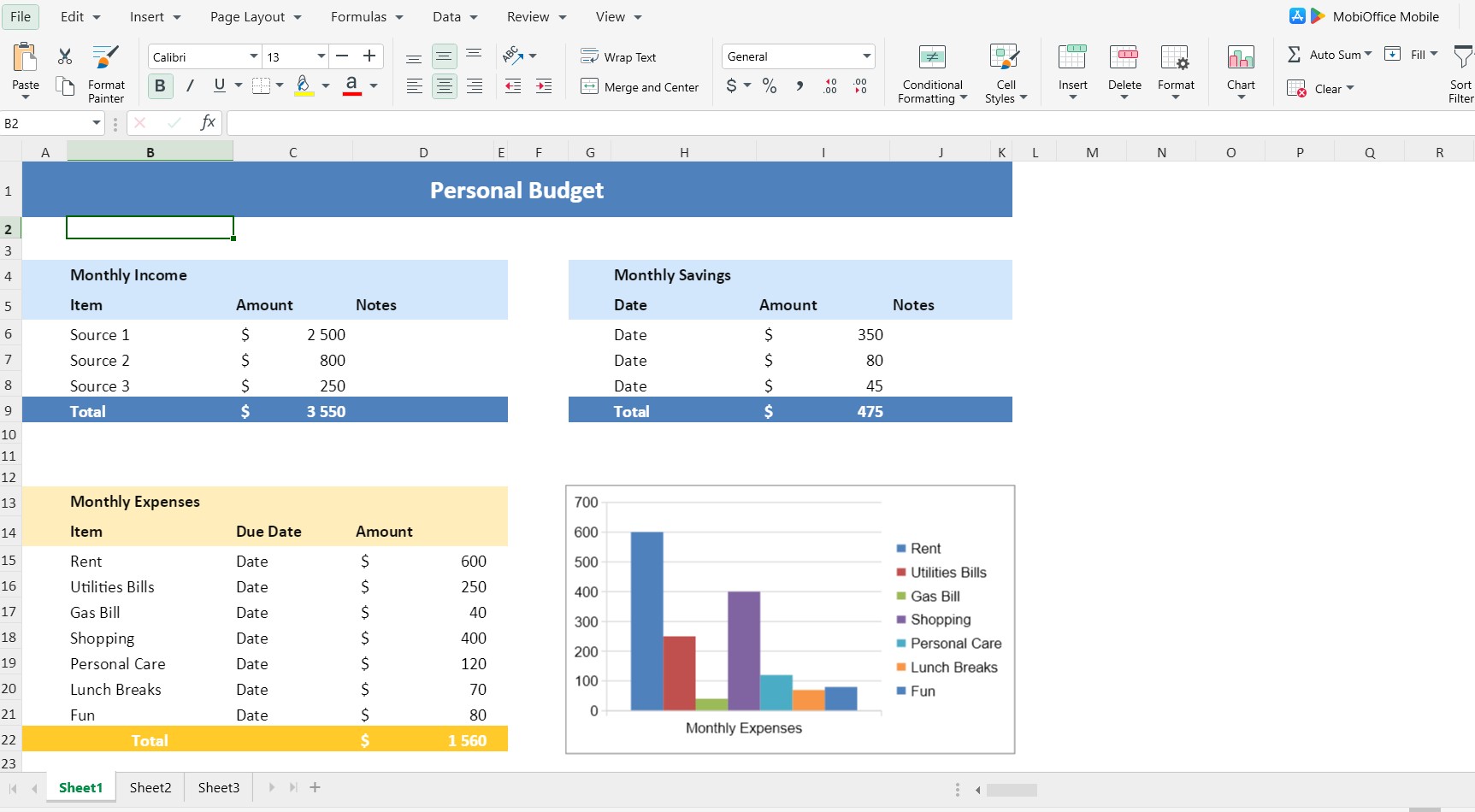

A budget spreadsheet template is a ready-to-use financial tracking sheet designed to help you organize your income, expenses, and savings. Instead of starting from scratch, you can download or open a simple budget spreadsheet template in Excel, Google Sheets, or MobiSheets and begin customizing it to your needs.

Most personal budget templates include:

Monthly income: Salary, freelance work, investments

Fixed/Monthly expenses: Rent, utilities, insurance, loan payments

Monthly savings: Emergency fund, retirement, vacation fund

Variable expenses: Groceries, dining out, entertainment

Savings & investment: Emergency fund, retirement, vacation fund

Balance tracking: How much money you’re keeping each month

Тhe beauty of templates is that the formulas and categories are usually built in. All you need to do is fill in your numbers. By customizing a budget spreadsheet to your own needs, you can track your finances effectively without expensive software or specialized financial knowledge.

Regularly updating and reviewing your sheet transforms it into a powerful financial management tool, helping you identify spending patterns, anticipate seasonal expenses, and adjust your savings and spending goals as your financial priorities change.

Looking for best accounting spreadsheets instead? See our top picks below.

Why use a budget spreadsheet template?

Budget spreadsheet templates strike the perfect balance between simplicity and customization. Compared to budgeting apps, spreadsheets give you more control over categories and formulas, while saving you the time of setting everything up manually.

Key benefits include:

1. Clarity in where your money goes

A budget spreadsheet helps you break down your income and expenses into clear categories. That way you know exactly how much is going toward rent, groceries, entertainment, or savings. By reviewing your totals each month, you can quickly spot overspending, identify areas to cut back, and make more informed financial decisions.

2. Flexibility to adjust the categories

Spreadsheet templates let you add, remove, or rename categories to fit your unique financial situation. Whether you have irregular freelance income, multiple side hustles, or unusual monthly bills, you can customize your budget to match your life.

3. Accessibility to use across devices

Budget spreadsheets can be opened and edited on your computer, tablet, or smartphone, making it easy to track your finances anytime, anywhere. With MobiSheets, you can work offline or online and seamlessly switch between devices without losing your data. This means you can update your expenses while waiting in line at the grocery store or review your monthly totals from your laptop at home.

Types of budget spreadsheet templates

Not all budgeting needs are the same. Here are some popular types you can use depending on your goals:

1. Personal budget spreadsheet template

This is the easiest way to track regular income/expenses and see exactly where your money is going each month, from fixed bills like rent and utilities to variable costs like groceries and entertainment. By reviewing totals each month, you can spot trends such as seasonal increases in utility bills or fluctuating spending on dining out. You might discover that you consistently overspend on streaming subscriptions and adjust your budget to cut unnecessary costs.

2. Annual budget spreadsheet template

Such a template is the easy way to plan big-picture finances across the year – making it easier to plan for large purchases, holiday spending, or yearly savings goals. You can also track changes in income or recurring annual expenses, like insurance premiums or property taxes. Using an annual spreadsheet can help you set aside money each month for a planned vacation or a big home renovation project.

3. Travel budget spreadsheet template

Estimate costs before a trip, from flights and accommodations to meals, transportation, and activities. By inputting estimated costs, you can avoid overspending while still enjoying your vacation. For example, a travel budget template can show that your accommodation costs are higher than expected, prompting you to adjust your itinerary or save more in advance.

4. Wedding budget spreadsheet template

Manage venue, catering, and guest expenses. Wedding templates break down all costs related to the big day, including venue, catering, décor, photography, and gifts. They can help you stay within your budget and avoid last-minute surprises.

5. Small business budget spreadsheet template

Monitor cash flow, expenses, and profits – for entrepreneurs, small business templates track income from sales, expenses for operations, and overall profits or losses. They are invaluable for managing cash flow, planning inventory purchases, and making strategic business decisions. A small business owner might notice that advertising costs are rising faster than revenue growth and decide to shift marketing efforts to a more cost-effective channel.

The best budget spreadsheet template is the one that matches your lifestyle and goals, so don’t hesitate to try out different tools until you find the one for you.

How to use a budget spreadsheet template effectively

Here’s a simple step-by-step guide to getting the most out of your budgeting spreadsheet:

1. Download or create a template

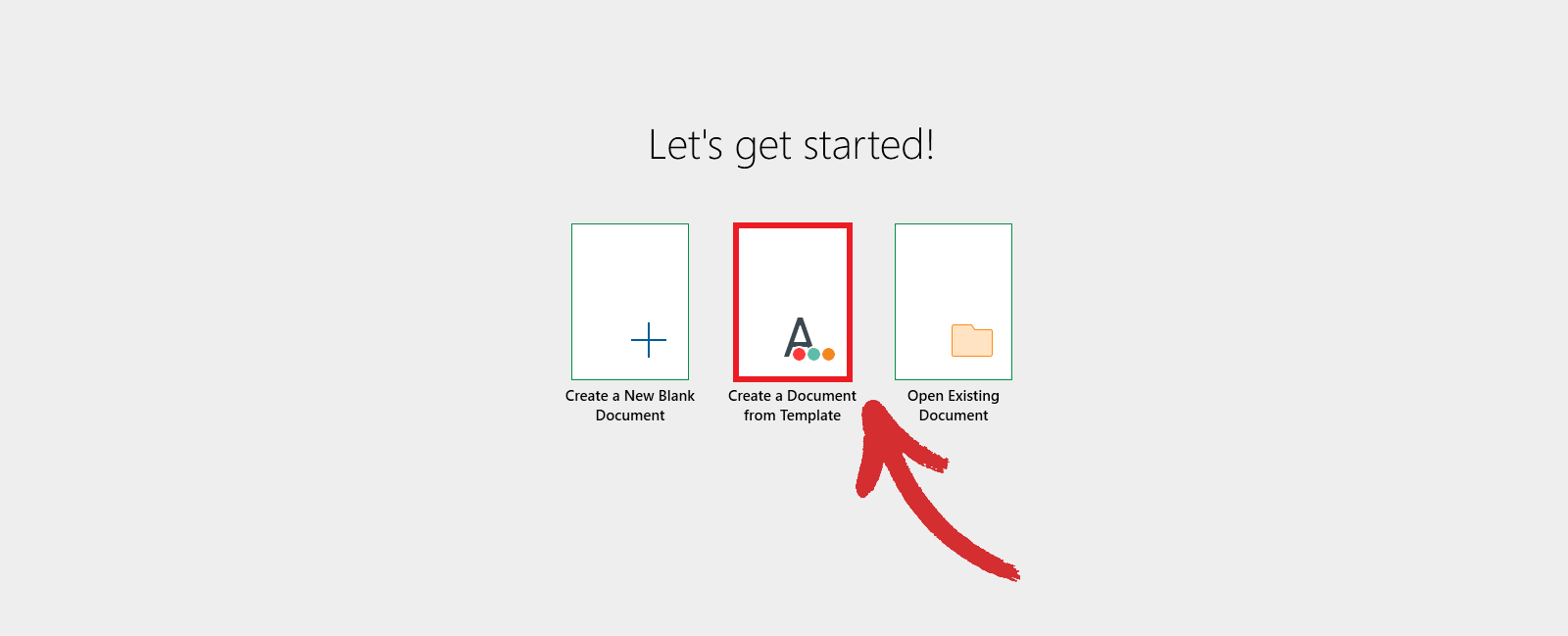

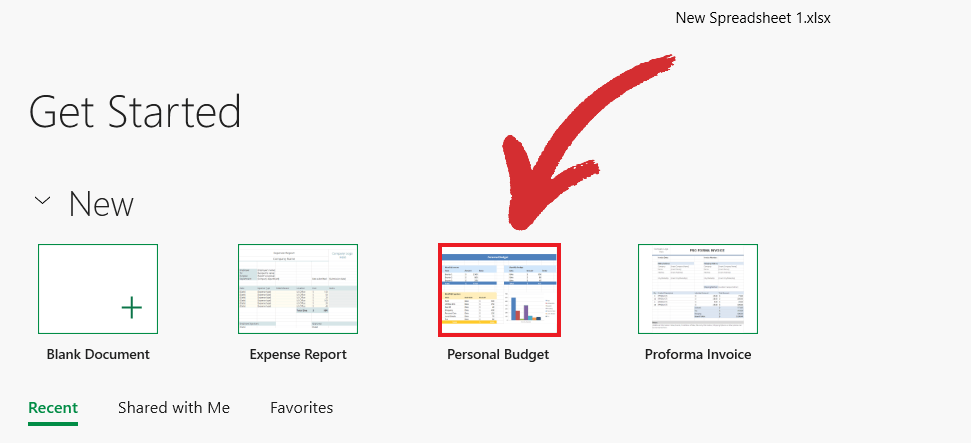

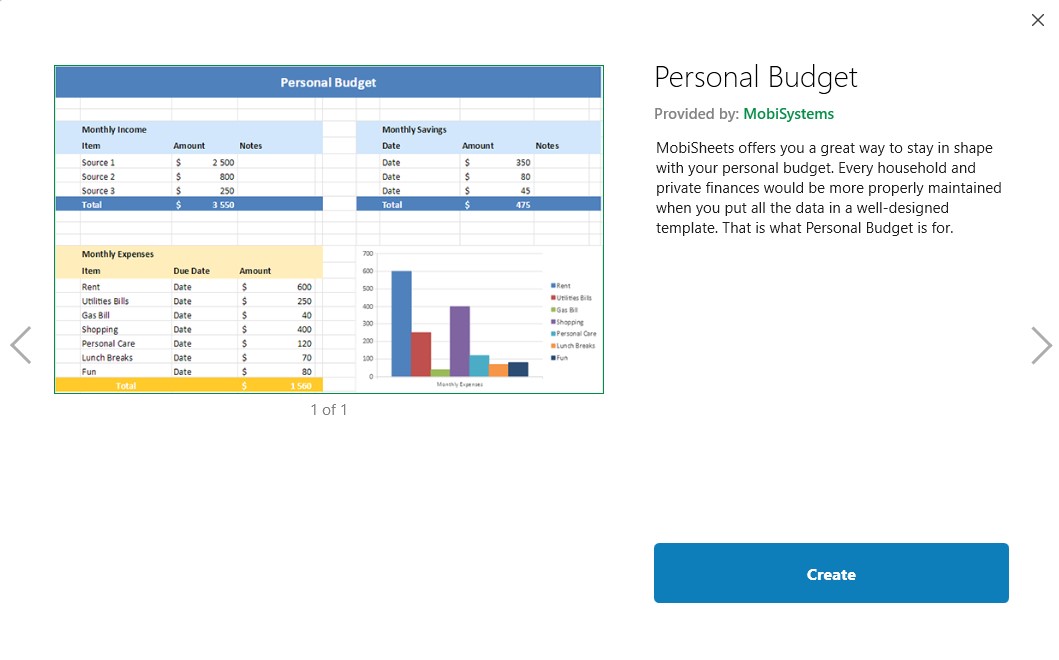

Start with a personal budget spreadsheet template free download or use built-in options like the Personal Budget template in MobiSheets. When you launch MobiSheets on your Windows device, you will immediately have the option to “Create a Document from a Template” – from there, you can see the gallery of all available templates.

2. Customize categories

In your chosen template, you can add specific expenses like streaming subscriptions, childcare, or gym memberships. Customize your budget template in whatever way you need.

3. Enter your income and expenses

Update the sheet at least weekly to avoid missing transactions and keep everything current, so you can have a good overview at any point of the month.

4. Review monthly totals

Look at where your money is going – are you overspending on dining out, subscriptions, or other categories? Many factors can affect your budget, such as a pay raise, a change in expenses, or a shift in financial goals. Regularly reviewing and updating your spreadsheet ensures it remains an effective tool that reflects your current situation.

5. Adjust and set goals

During this process, adjust categories, add new expenses, or revise savings goals as needed. Use your insights to plan savings targets, pay off debt faster, or prepare for upcoming events. Adjusting your budget ensures that your finances stay aligned with both short-term priorities, such as monthly bills, and longer-term objectives, like retirement or major life events.

Real-world uses for budget spreadsheet templates

Here are a few examples of how people use MobiSheets to track their spending:

1. Household bills

By tracking all household bills in a single spreadsheet, you can see the full picture of your monthly obligations at a glance. This helps prevent missed payments and ensures that recurring expenses are accounted for. Separating utilities, internet, and grocery costs into different categories makes it easier to spot where you might save each month.

2. Monthly expenses

A monthly tracking sheet helps you review spending patterns and identify areas for adjustment. You might notice that certain categories, like dining out or subscriptions, are consistently higher than expected. With this insight, you can make informed decisions about where to cut back or reallocate funds to better match your goals.

3. Savings goals

By adding specific columns for different savings goals, you can visually track progress toward each one. For example, you could have separate columns for an emergency fund, a vacation, or a home improvement project. Seeing these balances grow over time can be motivating and encourages disciplined saving habits.

4. Small businesses

Small business owners can use budget spreadsheets to manage income, operational expenses, and profits, providing a clear view of cash flow. For example, tracking inventory costs, payroll, and marketing spend in one sheet helps prevent budget overruns and supports strategic planning. Customizable templates allow businesses to adapt categories to their unique needs, ensuring accurate and actionable financial insights.

Both individuals and small business owners can easily manage their finances effectively, spot trends, and make proactive adjustments that keep spending aligned with goals.

Tips for maintaining your budget spreadsheet

To make your budgeting habit stick, follow these best practices:

1. Update regularly

Consistency is key to maintaining an effective budget. Entering expenses as they occur, or at least once a week, ensures your numbers reflect reality. Regular updates help you identify overspending early and prevent surprises at the end of the month.

2. Automate where possible

Formulas save time and reduce errors by automatically calculating totals, balances, and category subtotals. For example, a simple SUM formula can add all expenses in a category, while conditional formatting can highlight overspending.

3. Stay realistic

Creating an overly strict budget can be discouraging and difficult to maintain. Make sure you leave room for discretionary spending, occasional treats, or unexpected costs.

4. Print or share if needed

Printing your spreadsheet or sharing it with a partner can provide a tangible overview of your finances. This is useful for meetings, financial planning discussions, or simply keeping a paper record of progress. Having a physical copy ensures your budget is accessible even without a device.

Following these best practices helps you keep your budget spreadsheet accurate, actionable, and sustainable, turning it into a reliable tool for managing both short-term expenses and long-term financial goals.

Frequently asked questions

What is a budget spreadsheet template?

A budget spreadsheet template is a pre-designed sheet that helps you track income, expenses, and savings. Templates often include categories for bills, groceries, entertainment, and savings.

Where can I find a free budget spreadsheet template?

Many tools offer ready-to-use personal budget spreadsheet templates, monthly budget spreadsheet templates, and Excel-compatible options. With MobiSheets, you can also open and edit templates across devices.

Can I use a budget spreadsheet template for multiple financial goals?

Yes, templates can include separate categories for goals like emergency funds, travel, or big purchases. This allows you to monitor progress toward each goal in one sheet.

Are there printable budget spreadsheet templates available?

Yes, many templates can be printed for offline use. This is helpful for reviewing finances, sharing with family, or keeping a physical record of spending.

How do I choose the right spreadsheet template for my needs?

Look for templates that match your budgeting style, whether monthly, annual, or specific events like travel or weddings. Make sure it has clear categories and built-in formulas for easy tracking.

Can small businesses use budget spreadsheet templates?

Yes. Small business budget spreadsheets help track income, expenses, and profits, providing insights into cash flow and financial planning.

Why choose MobiSheets for budgeting?

While Excel and Google Sheets are common options, MobiSheets offers a user-friendly and affordable alternative designed to fit your lifestyle:

Compatible with all popular formats – Open, edit, and save Excel and other formats without any issues.

Cross-device access – Available on Android, iOS, Windows, and more, so you can work on-the-go if needed.

Affordable – This alternative is the cost-efficient solution that brings the same familiar functionalities and ease-of-use.

Offline access – Work on your budget even without an internet connection.

With MobiSheets, you can easily use any budget spreadsheet template Excel file or create your own from scratch.

Final thoughts

Using a budget spreadsheet template is one of the simplest ways to take control of your money. From household bills to travel planning, spreadsheets give you structure and insight into your spending habits.

And with MobiSheets, you don’t need to pay for expensive software or rely only on Google Sheets. You can access and edit your budget anywhere, with built-in templates and full Excel compatibility.

Ready to take control of your finances? Try MobiSheets today and start budgeting smarter.